Why Investing in Leveraged ETFs Is a Bad Idea for Long-Term Investors

Leveraged ETFs have exploded in popularity, promising double or even triple the daily returns of popular indexes. At first glance, this can sound like a shortcut to outsized gains. But beneath the surface, these products are built for traders, not investors, and their mathematical structure can quietly erode your wealth over time.

What Are Leveraged ETFs?

A leveraged ETF uses financial derivatives and debt to amplify the daily return of an underlying index. For example, a 2x S&P 500 ETF aims to deliver twice the daily movement of the S&P 500, whether up or down. If the S&P 500 rises 1% in a day, the ETF should rise 2%. If the index falls 1%, the ETF drops 2%.

But there’s a sneaky catch: leveraged ETFs reset their exposure every single day. This means the leverage applies only to that day’s movement, not to longer periods. Over time, the compounding effects of daily resets, especially in volatile markets, cause returns to deviate dramatically from what you’d expect by simply multiplying the index’s long-term return.

The Math: Why Leveraged ETFs Trend Toward Zero

Suppose you invest in a 2x leveraged ETF tracking an index. If the index falls 10% one day (ETF down 20%), then rises 11.1% the next (ETF up 22.2%), you might expect to break even. But you don’t. Here’s why:

- Start with $100.

- Day 1: Index drops 10% (ETF drops 20%). $100 → $80.

- Day 2: Index rises 11.1% (ETF rises 22.2%). $80 → $97.76.

You’ve lost money, even though the index is back to its starting point. This negative compounding effect gets worse with volatility, causing leveraged ETFs to lose value over time, even if the index goes sideways.

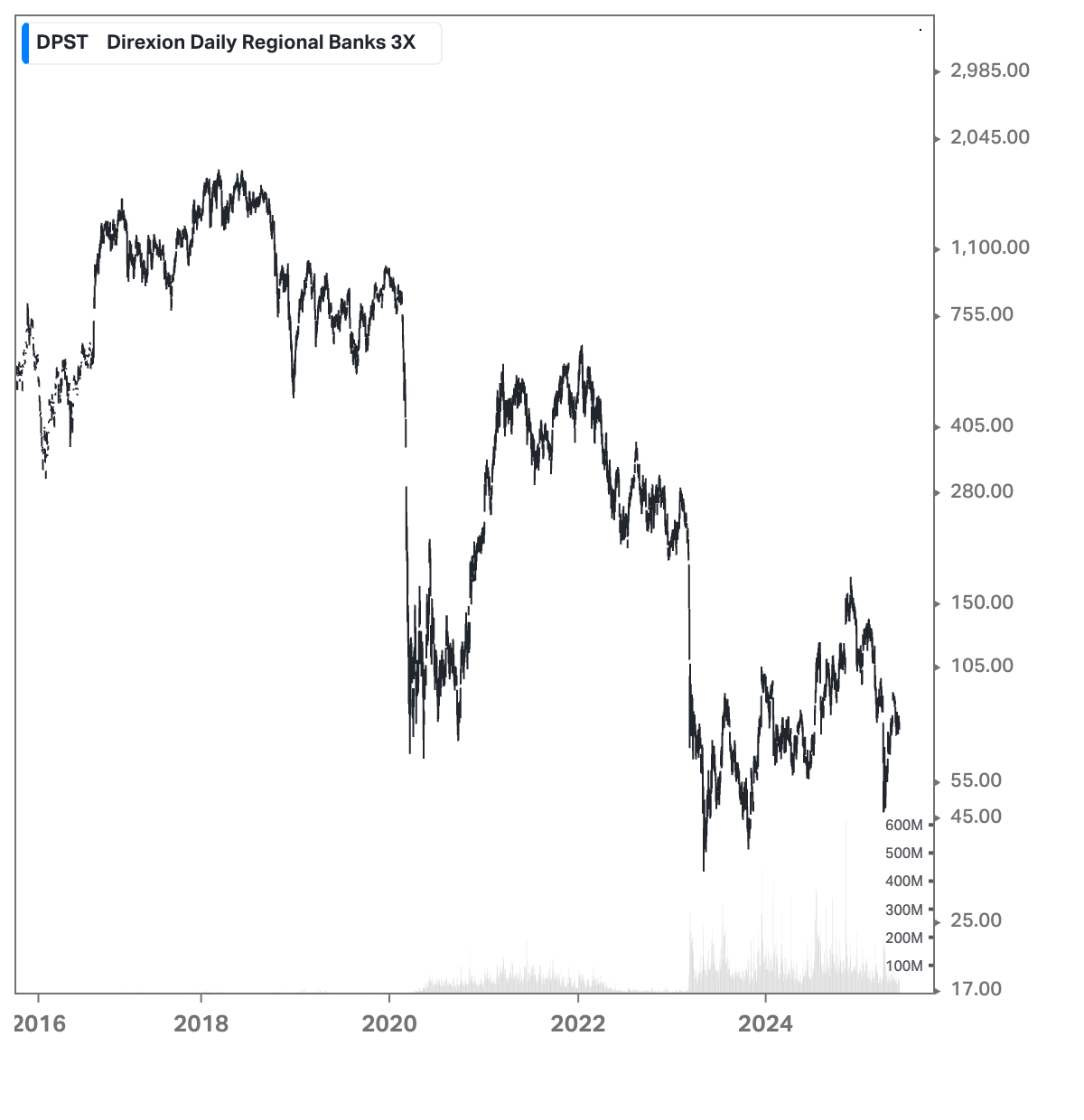

Check out the 3x Regional Bank ETF below. A few years back, the share price was trading over $1,600. Today, it's less than $100.

Even Treasuries Aren't Safe

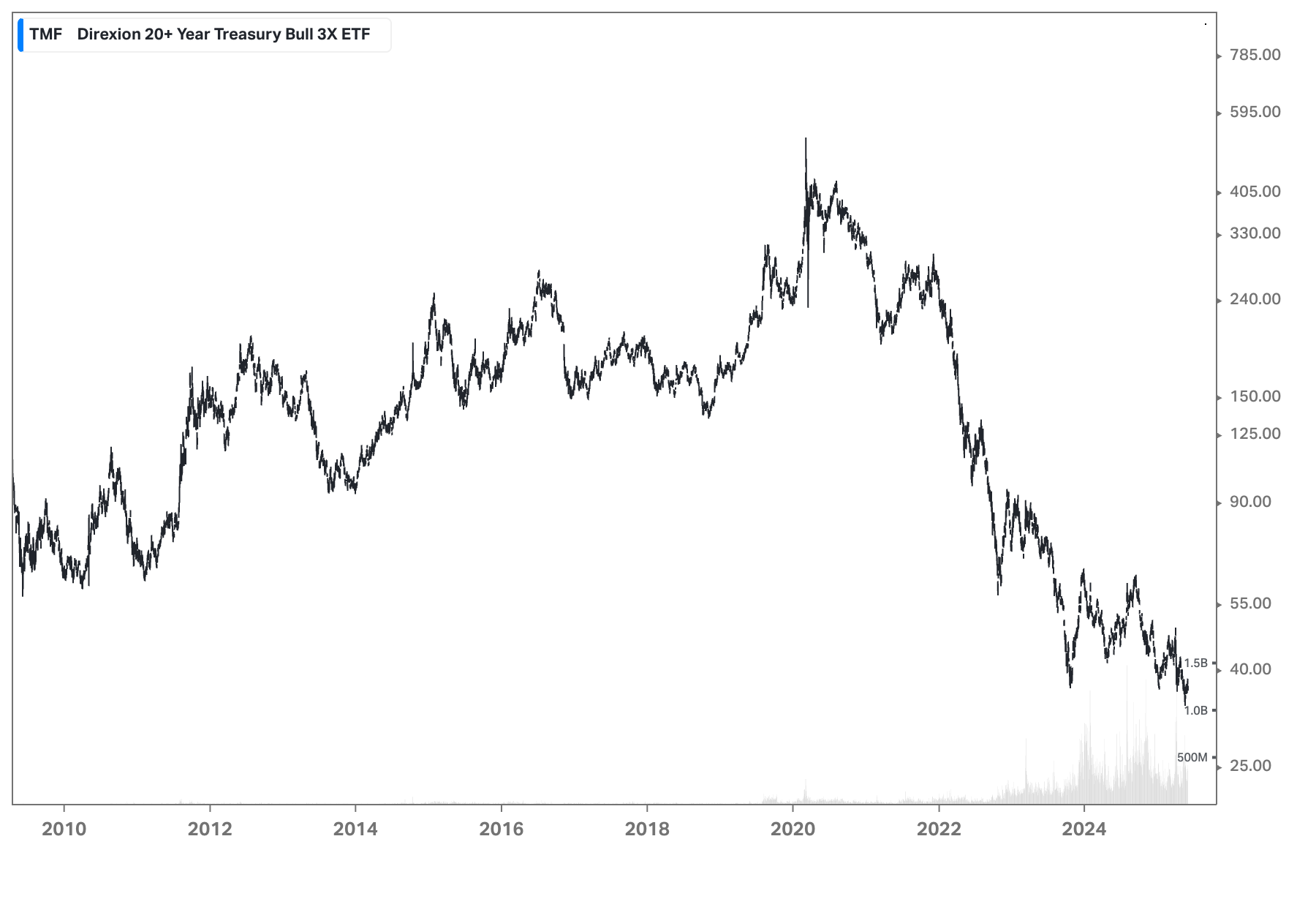

Below is a 3X leveraged Treasury bond ETF. At first glance, some investors might assume, “It’s just Treasuries, how risky can it be?” But long-term Treasuries, especially those with maturities over five years, can be highly volatile. This particular ETF is tied to 20-year Treasuries and uses 3X leverage, which significantly amplifies both gains and losses. That kind of setup is extremely sensitive to rising interest rates, and when rates did climb, the ETF suffered severe losses, crashing over 90%.

Speculation Isn’t Investing

Leveraged ETFs are designed for short-term speculation, not long-term investing. They’re tools for traders trying to profit from quick market moves, not for building wealth over years or decades. Speculating on short-term price swings is fundamentally different from investing in productive assets for the long haul.

True investing is about owning quality assets, holding through ups and downs, and letting compounding work in your favor. Speculation is a distraction, tempting you to chase quick gains while risking large, sudden losses.

The Rise of Speculative ETFs: A Growing Distraction

The ETF market is now flooded with speculative products, leveraged, inverse, and thematic funds that promise to turbocharge your returns. While they may seem exciting, these products often lure investors off track, away from the proven path of patient, diversified investing. The more you focus on these distractions, the less likely you are to achieve your long-term goals.

If your goal is to grow your wealth steadily and reliably, stick with traditional, diversified investments. Let the traders play with leverage.

Disclaimer:

The information provided in this article is for general informational purposes only and does not constitute investment, financial, legal, or tax advice. While every effort has been made to ensure the accuracy of the information, First Shelbourne makes no guarantees regarding its completeness or reliability. Readers should consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results. Investments involve risk, including the possible loss of principal. First Shelbourne is not responsible for any actions taken based on the information provided herein.