Understanding Sequence of Returns Risk: A Critical Factor for Retired Investors

Sequence of returns risk is one of the most significant but often overlooked threats to the financial security of retirees. It refers to the danger that the order in which investment returns occur, especially when combined with regular withdrawals, can dramatically affect how long a retirement portfolio lasts. For anyone relying on their investments to fund retirement, understanding this risk is essential.

What Is Sequence of Returns Risk?

When you retire and begin drawing down your investments, the timing of market gains and losses becomes critically important. If negative returns happen early in retirement while you are taking withdrawals, your portfolio can be depleted much faster than if those same losses occurred later. This is because each withdrawal during a market downturn locks in losses, leaving less capital to recover when the market eventually rebounds.

Why Is This Risk So Important for Retirees?

Retirees are especially vulnerable to sequence risk because they are no longer adding new money to their accounts. Instead, they depend on their savings to generate income. If a retiree is forced to sell investments during a market downturn to meet living expenses or make distributions from Required Minimum Distributions (RMDs), the portfolio may never fully recover, increasing the risk of running out of money.

Example: Two Retirees, Same Returns, Different Outcomes

Consider two investors, each starting retirement with $1 million and planning to withdraw $60,000 annually. Both experience the same average return over five years, but the sequence of those returns differs:

- Investor A enjoys positive returns in the first two years, then negative returns.

- Investor B suffers negative returns in the first two years, then positive returns.

Despite identical average returns and withdrawals, Investor B ends up with significantly less money after five years—over $80,000 less in some scenarios, simply because losses occurred while withdrawals were being made early on. Over a 20 to 30-year retirement, this difference can mean the distinction between financial security and running out of funds.

Why Own Treasuries in Retirement?

Many investors are frequently told to “just own an S&P 500 index fund.” While that advice may be practical in some situations, it can be particularly dangerous in retirement. If you experience a negative sequence of returns early on, the impact on your portfolio can be devastating.

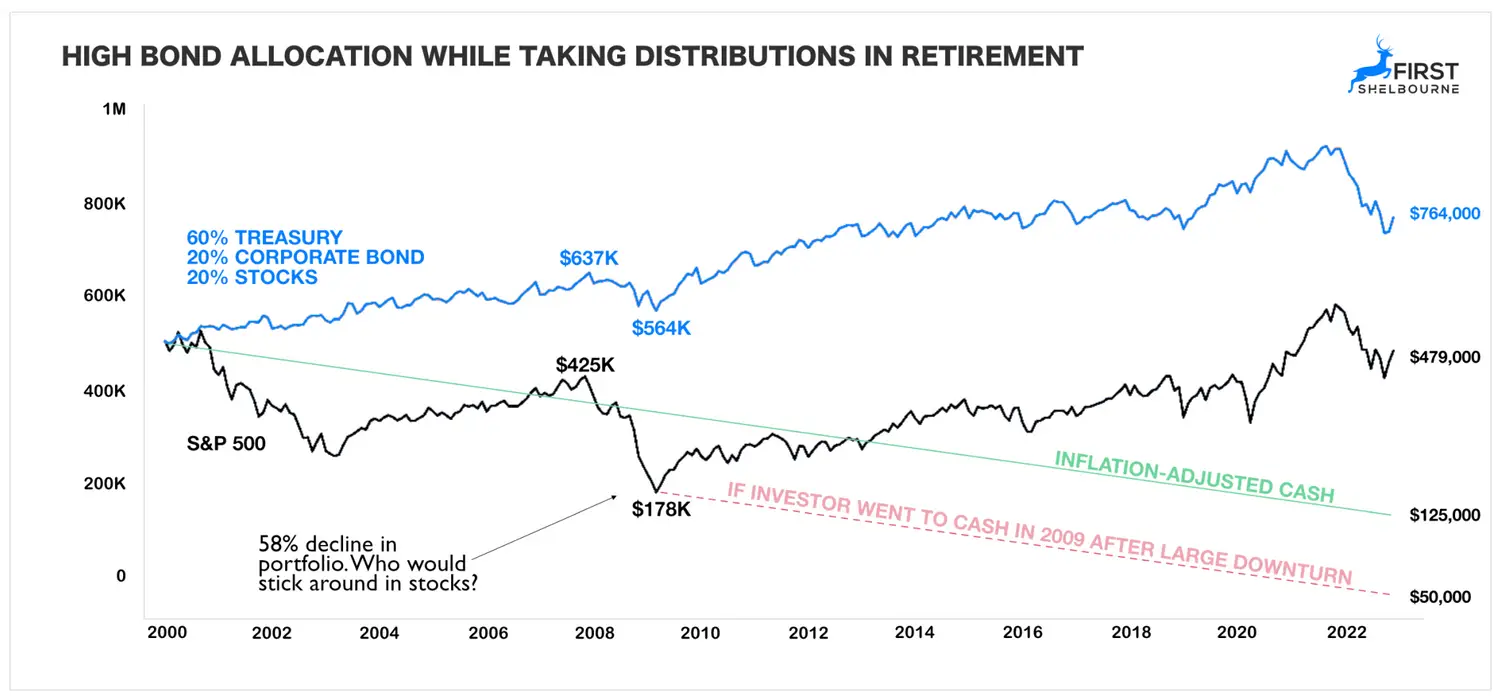

The chart below shows what happened to retirees in the year 2000.

From 2000 to 2003, the S&P 500 went through one of its worst bear markets, losing half its value over a prolonged three-year decline.

- The blue line shows an investor with a significant allocation to U.S. Treasuries.

- The black line shows an investor who went "all in" on the S&P 500.

- The red dotted line represents this 'all-in" investor who panicked and sold their entire stock portfolio at the bottom of the 2009 crash, then stayed in cash. Over time, inflation steadily eroded their purchasing power.

The Role of Fixed Income in Retirement

One of the most effective ways to manage the sequence of returns risk is to include fixed-income investments, such as bonds or cash equivalents, in your retirement portfolio. Fixed-income assets typically provide more stable returns and can serve as a buffer during market downturns. By drawing from these safer assets when the stock market is down, retirees can avoid selling stocks at depressed prices, giving their portfolios a better chance to recover.

Disclaimer:

The information provided in this article is for general informational purposes only and does not constitute investment, financial, legal, or tax advice. While every effort has been made to ensure the accuracy of the information, First Shelbourne makes no guarantees regarding its completeness or reliability. Readers should consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results. Investments involve risk, including the possible loss of principal. First Shelbourne is not responsible for any actions taken based on the information provided herein.