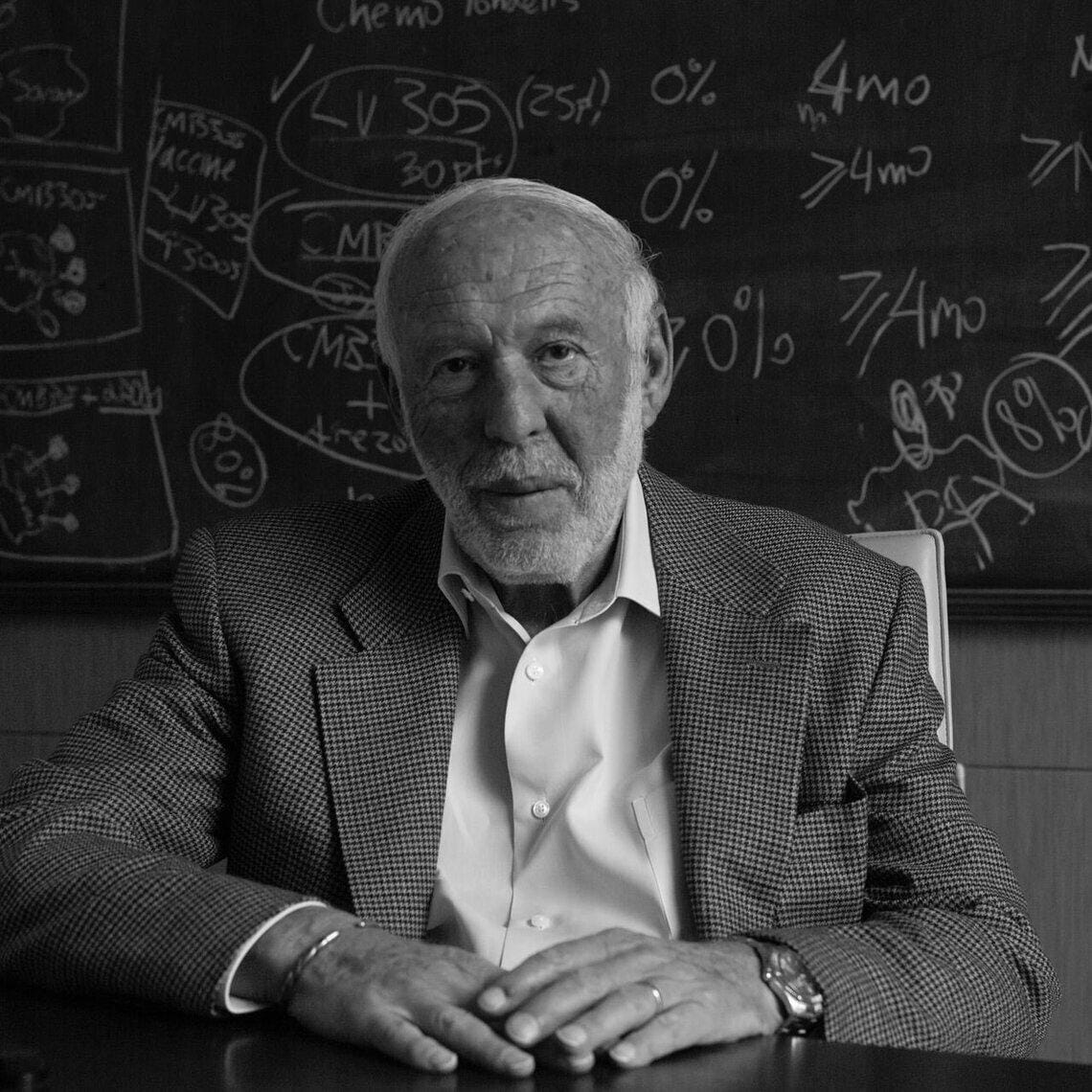

Jim Simons: The Quant King Who Changed Investing Forever

When you think of legendary investors, names like Warren Buffett or Peter Lynch might spring to mind. But in the world of finance, few have had as profound and mysterious an impact as Jim Simons, the mathematician who founded Renaissance Technologies and pioneered the field of quantitative trading. Even after his passing in 2024, Simons’ legacy continues to shape how markets work and how investors think about making money.

From Academia to Wall Street: A Reluctant Outsider

Jim Simons’ journey was anything but typical. Born in 1938, he showed an early passion for mathematics, earning a Ph.D. from UC Berkeley by age 23. He taught at MIT and Harvard, chaired the math department at Stony Brook University, and even worked as a codebreaker for the National Security Agency during the Vietnam War. By his early 40s, Simons was already a celebrated mathematician, but his curiosity and drive led him to leave academia and venture into finance.

He started his first hedge fund, Monemetrics, in 1978, and after a few years of experimentation, he founded Renaissance Technologies in 1982.

The Birth of Quantitative Trading

Simons’ big idea was simple: use mathematical models and algorithms to find patterns in financial markets and trade on them. This approach, known as quantitative or “quant” trading, was virtually unheard of at the time. Renaissance’s flagship Medallion Fund became legendary for its secrecy and its staggering performance, reportedly delivering average annual net returns of nearly 40% for decades. The firm’s success was so consistent that it seemed almost magical, and competitors scrambled to imitate its methods, though none have matched its results.

What set Renaissance apart wasn’t just its technology, but its culture. Simons fostered an environment where scientists collaborated freely, challenging each other’s ideas and constantly refining their models. Renaissance’s “secret sauce” was this blend of intellectual rigor, creativity, and relentless pursuit of new insights.

Many Roads to Investment Success

Jim Simons’ story is a powerful reminder that there is no single path to success in investing. While Simons and his team used data, code, and machine learning to beat the market, other investors rely on fundamental analysis, studying companies’ financials, management, and competitive advantages. Both approaches can work, as long as they fit the investor’s skills, temperament, and philosophy.

The Importance of Authenticity: Do What Fits You

One of the most inspiring lessons from Jim Simons’ life is the importance of following your own path. Simons could have spent his life as a celebrated academic, or simply invested in index funds and called it a day. But he was drawn to puzzles, to challenges, and to doing things differently. He built Renaissance Technologies not by copying others, but by leaning into his own strengths and passions.

Lessons for Investors: Charting Your Own Course

At First Shelbourne, I embrace this philosophy by combining rigorous stock selection with broad market exposure, always seeking to add value for my clients in a way that reflects my own expertise and convictions. I don’t believe in fitting in for its own sake.

Disclaimer:

The information provided in this article is for general informational purposes only and does not constitute investment, financial, legal, or tax advice. While every effort has been made to ensure the accuracy of the information, First Shelbourne makes no guarantees regarding its completeness or reliability. Readers should consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results. Investments involve risk, including the possible loss of principal. First Shelbourne is not responsible for any actions taken based on the information provided herein.