How Federal Tax Brackets Work: Marginal vs. Effective Tax Rates Explained

Understanding how federal tax brackets work can help you make smarter financial decisions and potentially save money through effective tax planning. Many people misunderstand how their income is taxed and the difference between marginal and effective tax rates. Here’s a clear breakdown, with examples and a look at how brackets differ for singles and married couples.

The Progressive Tax System

The U.S. federal income tax system is progressive, meaning your income is taxed in layers, with each layer (or "bracket") taxed at a different rate. As your income increases, only the dollars above certain thresholds are taxed at higher rates, not your entire income.

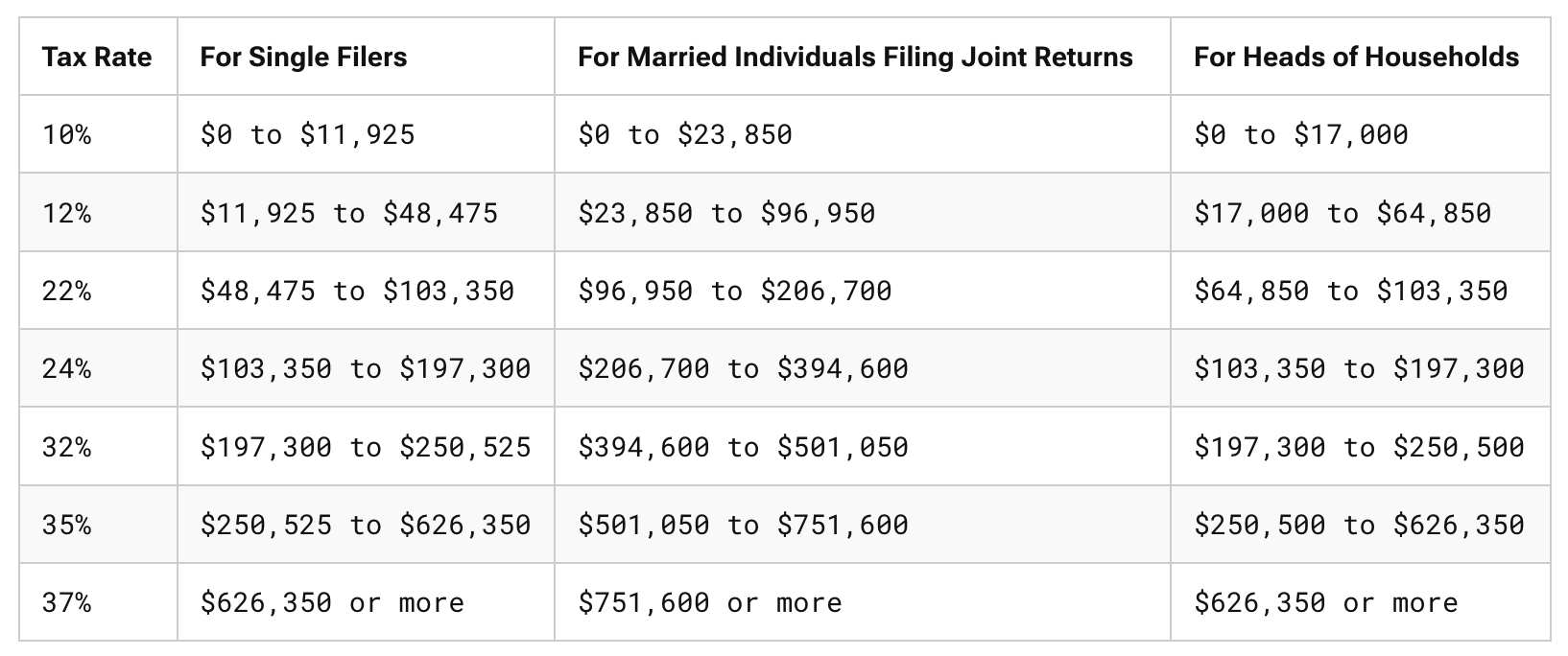

2025 Federal Tax Brackets

Marginal vs. Effective Tax Rates

- Marginal Tax Rate: The rate you pay on your next dollar of income. It’s determined by the highest bracket your income reaches.

- Effective Tax Rate: Your average tax rate or total tax paid divided by your total income. This is always lower than your marginal rate because much of your income is taxed at lower rates.

Example: Single Filer with $60,000 Taxable Income

Let’s break down how much tax is owed:

For 2025, the standard deduction for a single filer is $15,000 (for married couples, it's $30,000. For now, we are dealing with a single filer).

- Gross income: $60,000

- Minus standard deduction: $15,000

- Taxable income: $45,000

Now, let’s see how this $45,000 is taxed using the 2025 brackets for single filers:

- 10% bracket: First $11,925 → $1,192.50

- 12% bracket: Next $33,075 ($11,926 to $45,000) → $3,969

Total federal tax:

$1,192.50 (10% bracket) + $3,969 (12% bracket)

= $5,161.50

- Marginal tax rate: 12% (the rate on the last dollar earned)

- Effective tax rate (what your overall tax rate is): $5,161.50 ÷ $60,000 = 8.6%

Including the standard deduction significantly reduces taxable income and the total tax owed. Most taxpayers benefit from this automatic reduction, which is why understanding how it works is important for accurate tax planning. Read my post, "Understanding the Standard Deduction" for more information on this important topic.

Tax Planning: Staying in a Lower Bracket

With smart tax planning, you can manage your taxable income to avoid moving into a higher bracket. For example, contributing more to pre-tax retirement accounts like a 401(k), increasing HSA contributions, or timing deductions can keep more of your income in lower brackets.

Example: Married Couple Filing Jointly

Suppose a married couple expects $100,000 in taxable income. The 22% bracket starts at $96,951, so only $3,049 of their income is taxed at 22%. If they contribute $5,000 to a pre-tax 401(k), their taxable income drops to $95,000, keeping all their income in the 12% bracket. Understanding strategies like this is extremely important when discussing Roth Conversions.

Understanding these concepts can help you make better decisions and reduce your tax bill, now and in the future.

Disclaimer:

The information provided on this website is for general informational and educational purposes only and does not constitute tax, legal, or accounting advice. I am not a licensed tax advisor and nothing on this site should be relied upon as tax advice for your specific situation. Tax laws are complex, subject to change, and can vary based on individual circumstances. You are strongly encouraged to consult with a qualified tax professional or advisor before making any decisions or taking any actions based on the information provided here. By using this website, you acknowledge and agree that I am not responsible for any tax consequences that may arise from your use of the information contained herein.